Malaysia will bear the brunt of weaker exports to the US, and the economic damage could prompt the government to also delay subsidy rationalisation, Macquarie flagged on Tuesday.

Macquarie’s analysis indicates that direct, first-order impact will drag on Malaysia’s gross domestic product (GDP) by 1.02 percentage points based on the headline 10% tariff. However, a 25% tariff on semiconductors, if levied, could hit Malaysia’s GDP by 2.15 percentage points, Macquarie cautioned.

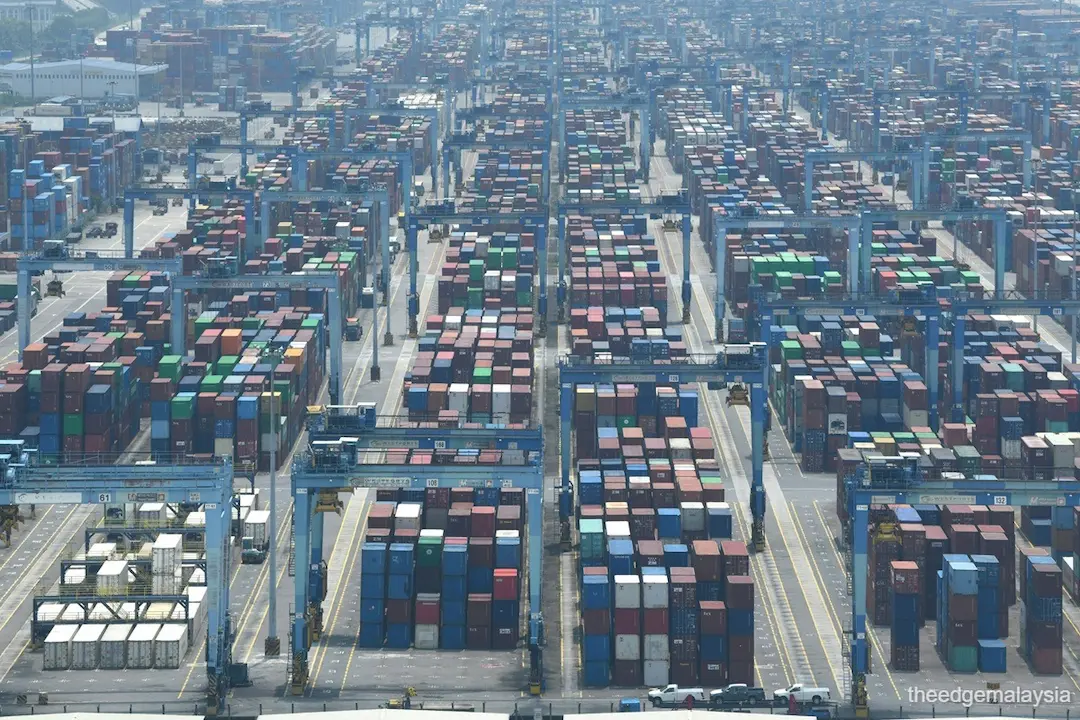

Semiconductors, Malaysia's largest exports, currently remain exempt from sweeping US tariffs but Macquarie warned that the impact will be significant if the US decides to impose a 25% levy.

The US is currently investigating imports of semiconductors and pharmaceuticals under the so-called Section 232 of the Trade Expansion Act of 1962 on grounds that extensive reliance on foreign production of medicine and chips is a national security threat.

Section 232 probes must be completed within nine months of initiation. The investigation, which began on April 1, follows exemptions announced over the weekend for consumer electronics and semiconductor equipment from the punitive reciprocal tariffs.

A weaker oil price reduces the fiscal pressure on fuel subsidy regimes, which is a “mixed blessing” for Malaysia since it will cut into the government’s reform efforts, Macquarie said.

“It is likely that Malaysia will now defer any reform on RON95 gasoline prices given the narrowing gap between the market and subsidised price, as well as a less predictable economic backdrop,” the Australian investment bank said.

That is positive for mass market and domestic consumer franchises, Macquarie noted. For positioning, Macquarie prefers defensive, domestic champions over trade-exposed sectors and selects healthcare, utilities, staples and quality domestic bank franchises.

Regional, trade-oriented banking models will face tough times ahead, while quality, well-funded domestic banking franchises look better placed.

Source: The Edge Malaysia

Share: